2025-06-08 21:38 Tags: Money

https://youtu.be/-r2SH6EH5eY?si=nQ1xjwWQ8CxmVKuo

if you wanna make money, you need make people are willing to give the money vonluteraily.

So you need to give them value, the value the care > the money

I. The Core Premise: Wealth is a Game

- Getting rich is not random — it’s a structured game with clear rules, levels, players, and strategies.

- This video is about understanding:

- The rules of the game

- Key actions you can take

- Different ways of playing (individual vs. business)

- The four levels of economic participation

- And the barriers that keep people from winning

II. The Three Rules of the Game

- Only governments/central banks can create money.

- For you to make money, someone else must give it to you.

- They must give it to you voluntarily, meaning you must offer something they value more than the money they give up.

→ Insight: The core of wealth-building is value exchange — people pay when they feel what you’re offering is worth more than their money.

III. The Strategy: Create and Exchange Value

- Why do people buy coffee or iPhones? Because they want the product more than they want to keep the money.

- Making money = creating value + exchanging it.

- This is the core strategy, regardless of career or business path.

IV. Different Types of Value (But Only One Matters)

- Human value – Your worth as a person (intrinsic).

- Societal value – Importance of your work to society (e.g., teachers, firefighters).

- Market value – What someone is willing to pay for your work/product.

→ In the money game, only market value matters.

Even if something is valuable to society, if no one pays for it, it doesn’t make you rich.

Example: Water is essential but cheap. Diamonds are not essential but expensive.

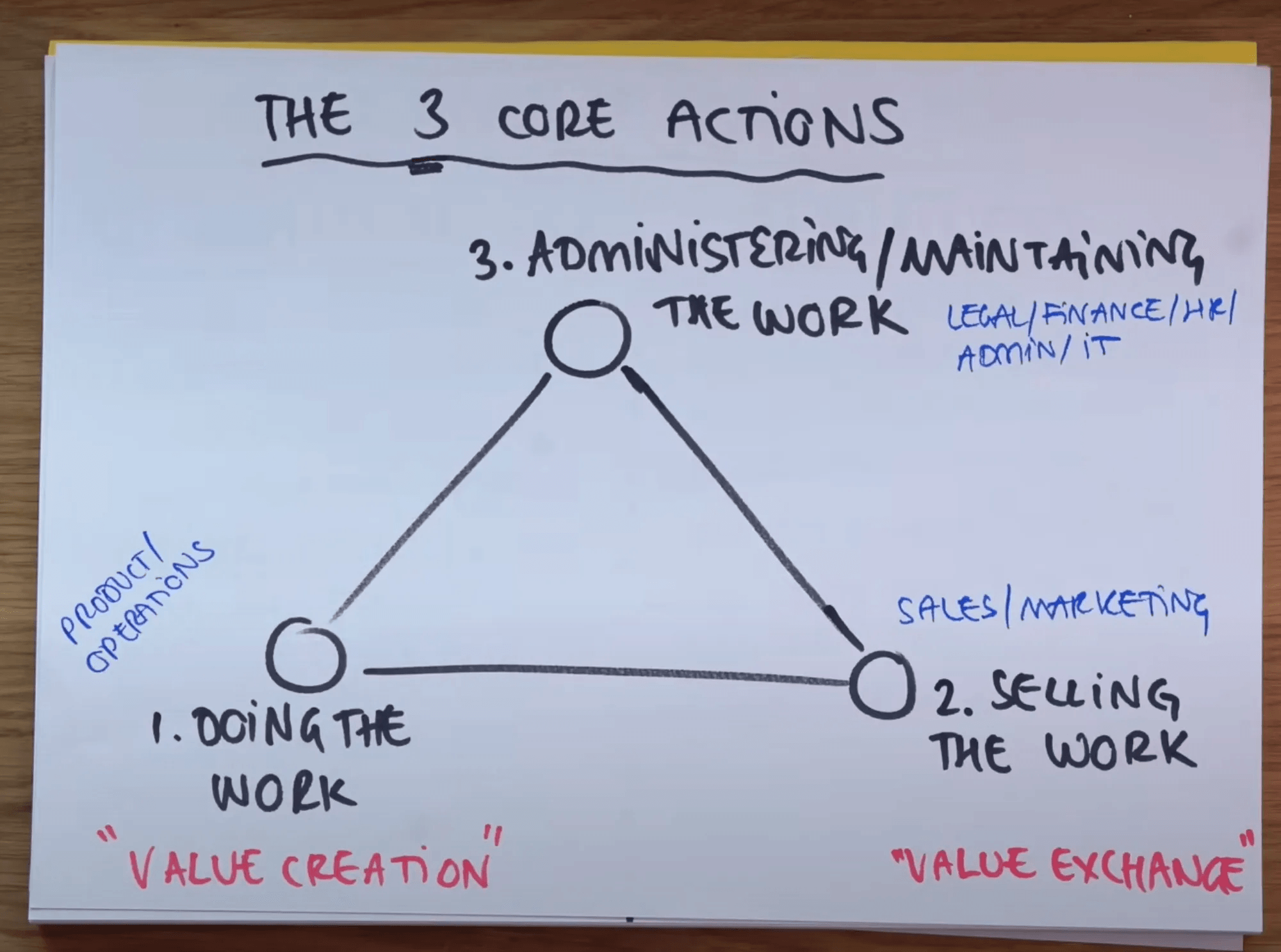

V. The Three Core Actions in the Game

Every economic actor (person or business) does three things:

Every economic actor (person or business) does three things:

- Do the work – Build the product, offer the service (e.g., write code, treat patients).

- Sell the work – Convince others to pay for it.

- Administer the work – Maintain the ability to do and sell (e.g., accounting, compliance, skills).

Mastering these is key to moving up the game levels.

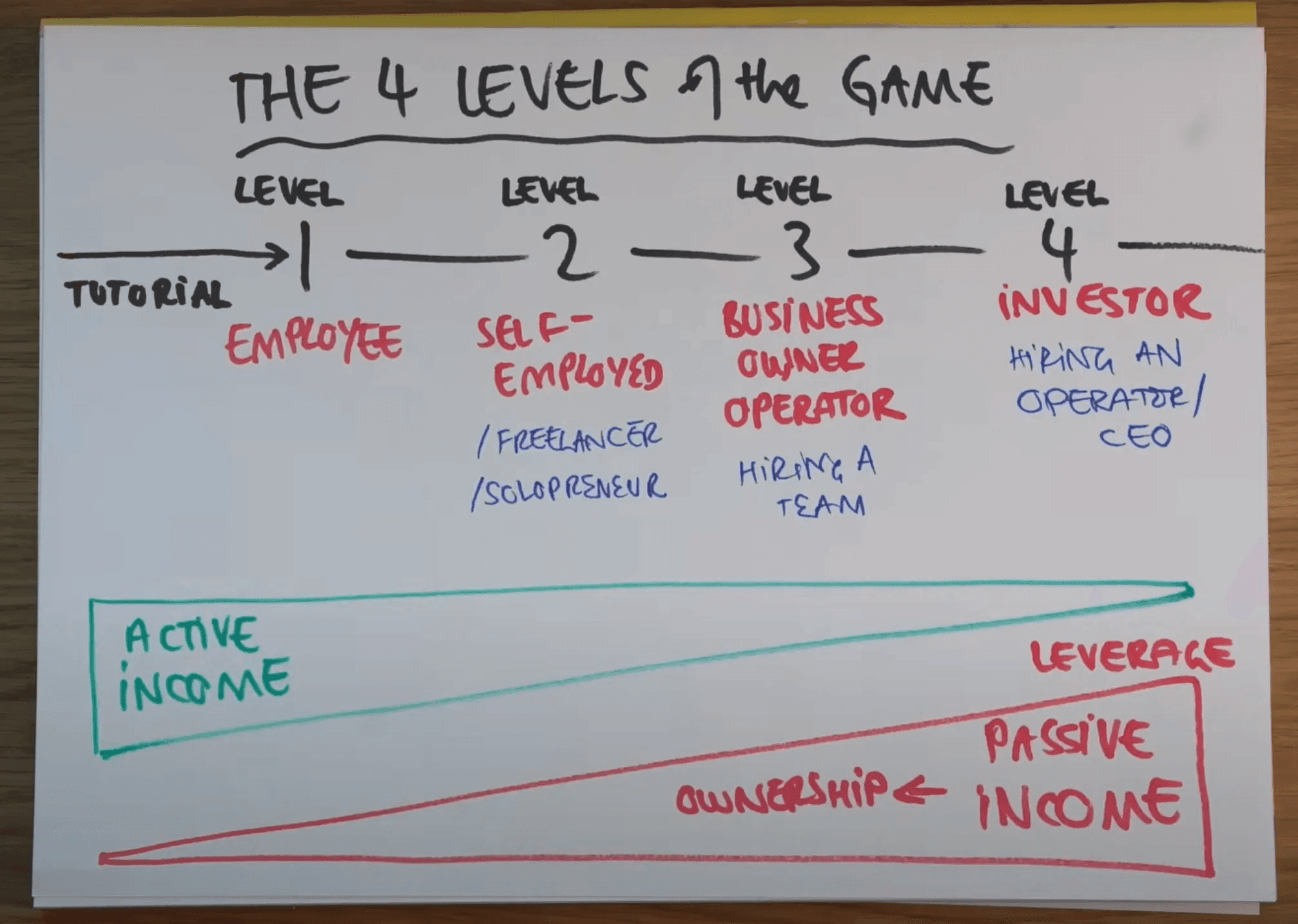

VI. The Four Levels of the Game

Tutorial – Age 0–21: Education, learning to be employable.

Level 1: Employee

- You do work, sell it to one buyer (your employer), and manage your job obligations.

- Spend most of your time doing, very little selling.

- Stable but low leverage. You can get rich only if your work has exceptionally high market value (e.g., top trader, tech lead).

Level 2: Self-Employed (Freelancer/Solopreneur)

- You do all three actions yourself.

- Must find your own clients, i.e., sell actively.

- Less time spent doing the work, more time selling(at least>50%) and administering.

- You gain flexibility, better tax treatment, and pricing control — but the stress of client acquisition is high.

Level 3: Business Owner/Operator

- You hire others to help with work.

- Your job shifts toward management and strategic sales.

- You spend more time administering and selling, less on doing.

- Still stressful, but scalable. You’re building a machine.

Level 4: Investor

- You own the business but don’t operate it.

- Hired managers/CEOs run it.

- Your income becomes mostly passive, based on ownership and leverage.

- You make money from what you own, not what you do.

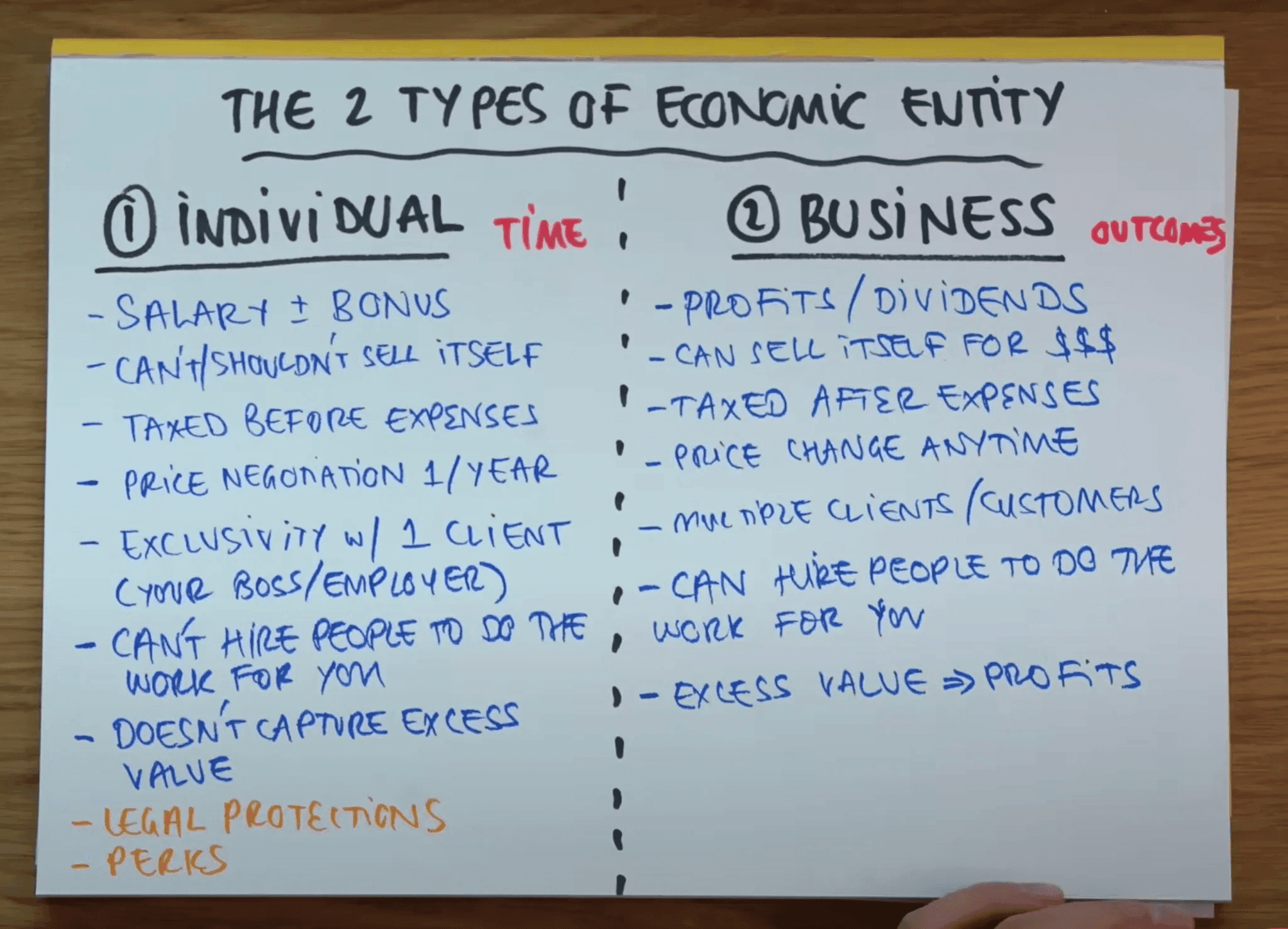

VII. The Two Economic Roles: Individual vs. Business

| Feature | Individual | Business |

|---|---|---|

| Income type | Salary | Profits/dividends |

| Taxes | Before expenses | After expenses |

| Selling | One client (employer) | Many customers |

| Time vs. Outcome | Paid for time | Paid for results |

| Scale | No leverage | Can hire, automate, scale |

| Risk | Lower (but dependent) | Higher (but diversified) |

Key Insight: The system favors businesses with more tax benefits, control, and upside.

VIII. Three “S” Barriers That Hold People Back

- Stability/Security – Fear of losing a steady paycheck.

- Stress – Fear of pressure, responsibility, uncertainty.

- Sales – Discomfort with self-promotion or selling.

→ Most people stay as employees because these 3 factors feel safer than running a business.

→ But these same factors also limit financial upside.

IX. Critical Insight: Sales Is the Bottleneck

- Sales is the hardest part of getting rich, but also the most valuable skill.

- If you can sell yourself, your product, or your service, you’ll never be out of work.

- This is true across all levels of the game.

X. How to “Win” the Game of Getting Rich

-

Get close to the money

Work in roles that directly bring in revenue (sales, growth, partnerships).

-

Learn to sell

Whether selling products, ideas, or yourself — this is non-negotiable.

-

Build a personal brand

A strong professional reputation brings inbound opportunities and trust.

-

Start a money-making side hustle

Learn by doing. If it grows, it can become your main thing.

-

Invest or negotiate for ownership

Long-term wealth comes from owning assets, not trading time.

XI. Final Thought

You’re already a business — You Inc.

The difference is whether you’re selling your time to one client (your employer) or leveraging your skills, assets, and network for greater reach and return.

If you want to win the game, understand it. Then level up intentionally.

Would you like this turned into a visual outline or Notion-friendly format too?